Today’s top story: What Equifax’s credit score miscalculations mean for consumers. Also in the news: 5 ways to feel richer (even if you’re not), mortgage rates to stay high in August, and who should consider a spousal IRA.

Today’s top story: What Equifax’s credit score miscalculations mean for consumers. Also in the news: 5 ways to feel richer (even if you’re not), mortgage rates to stay high in August, and who should consider a spousal IRA.

What Equifax’s Credit Score Miscalculations Mean for Consumers

Equifax, one of the three major credit bureaus, announced that a computer coding error resulted in the miscalculation of credit scores for consumers in a three-week period between March 17 and April 6.

5 Ways to Feel Richer (Even If You’re Not)

In some ways, feeling “rich” is less about how many zeroes you have in your bank account and more about knowing how to use them to get what you want out of life.

Mortgage Rates Unlikely to Cool in August

Mortgage rates will likely rise in August as the Federal Reserve continues to yank interest rates higher.

Who Should Consider a Spousal IRA, According to a Financial Planner

You should try to find new ways to save for retirement. For some people, a spousal IRA is an option.

Today’s top story: 4 things to know if you’ve never budgeted before. Also in the news: Equifax breach – claims cutoff and more scammers ahead, how auto insurers use your nondriving habits to raise prices, and the benefits of filing taxes early.

Today’s top story: 4 things to know if you’ve never budgeted before. Also in the news: Equifax breach – claims cutoff and more scammers ahead, how auto insurers use your nondriving habits to raise prices, and the benefits of filing taxes early. Things to watch out for in the Equifax data breach settlement, why you need a midyear budget check-in, and how much you’ll need to invest each month in order to retire with a million dollars.

Things to watch out for in the Equifax data breach settlement, why you need a midyear budget check-in, and how much you’ll need to invest each month in order to retire with a million dollars. Today’s top story: What you might get from the Equifax data breach settlement. Also in the news: 5 logical credit moves that can lead to trouble, 8 money mistakes newlyweds make, and how to decide if you should get a cash-back credit card.

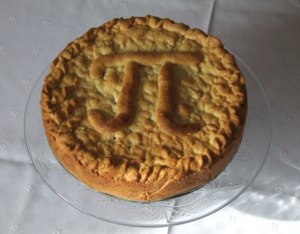

Today’s top story: What you might get from the Equifax data breach settlement. Also in the news: 5 logical credit moves that can lead to trouble, 8 money mistakes newlyweds make, and how to decide if you should get a cash-back credit card.  Today’s top story: 7 places to get a slice of savings on Pi Day. Also in the news: Choosing between a Roth 401(k) and a Roth IRA, guarding your cash from debit card fraud, and credit bureaus may get a boost from Congress.

Today’s top story: 7 places to get a slice of savings on Pi Day. Also in the news: Choosing between a Roth 401(k) and a Roth IRA, guarding your cash from debit card fraud, and credit bureaus may get a boost from Congress. Today’s top story: Why tax refunds aren’t fun anymore. Also in the news: 12 first-time home buyer mistakes and how to avoid them, 9 easy ways to earn travel rewards you’ll actually use, and Equifax says hackers stole more info than previously reported.

Today’s top story: Why tax refunds aren’t fun anymore. Also in the news: 12 first-time home buyer mistakes and how to avoid them, 9 easy ways to earn travel rewards you’ll actually use, and Equifax says hackers stole more info than previously reported.