Dear Liz: I have a Roth 401(k). Are withdrawals from it the same as from a Roth IRA? And how do I move it to a Roth IRA?

Answer: Roth 401(k)s are a type of workplace retirement plan that, like Roth IRAs, allow tax-free withdrawals. But the rules for Roth 401(k)s are somewhat different from those governing Roth IRAs.

For example, a Roth IRA allows you to withdraw an amount equal to your contributions free of taxes and penalties anytime, regardless of your age. Earnings can be withdrawn from a Roth IRA tax- and penalty-free once you’re 59½ and the account is at least 5 years old. The clock starts on Jan. 1 of the year you make your first contribution.

To withdraw money tax- and penalty-free from a Roth 401(k), you typically must be 59½ or older and the account must be at least 5 years old.

In addition, Roth 401(k)s — like regular 401(k)s and traditional IRAs — are subject to required minimum distribution rules that require you to start taking money out at age 72. Roth IRAs aren’t subject to those rules.

Many people roll their Roth 401(k)s into Roth IRAs to avoid the required minimum distribution rules or to have more investment choices. Such a rollover resets the five-year clock that determines whether a withdrawal incurs taxes and penalties, however. If you wait until you retire to roll over your Roth 401(k) and need access to the money, that waiting period could be problematic.

You can roll over your Roth 401(k) after leaving the employer that offers the plan. But you also could ask if your plan allows “in service” rollovers — in other words, rollovers while you’re still working for the employer. Some Roth 401(k)s allow these, although they may be restricted to people 59½ and older.

Today’s top story: These 4 tax scams could really cost you. Also in the news: 3 times you can pay taxes with plastic and come out ahead, how to decide between investing in a 401(k) or a Roth 401(k), and the 5 best free money-management apps.

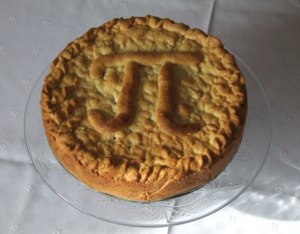

Today’s top story: These 4 tax scams could really cost you. Also in the news: 3 times you can pay taxes with plastic and come out ahead, how to decide between investing in a 401(k) or a Roth 401(k), and the 5 best free money-management apps.  Today’s top story: 7 places to get a slice of savings on Pi Day. Also in the news: Choosing between a Roth 401(k) and a Roth IRA, guarding your cash from debit card fraud, and credit bureaus may get a boost from Congress.

Today’s top story: 7 places to get a slice of savings on Pi Day. Also in the news: Choosing between a Roth 401(k) and a Roth IRA, guarding your cash from debit card fraud, and credit bureaus may get a boost from Congress.