Today’s top story: 12 tips to cut your tax bill. Also in the news: Why Millennials shouldn’t forget about estate planning, 7 amazing things to be after you die, and the U.S. cities with the highest credit scores.

Today’s top story: 12 tips to cut your tax bill. Also in the news: Why Millennials shouldn’t forget about estate planning, 7 amazing things to be after you die, and the U.S. cities with the highest credit scores.

12 Tips to Cut Your Tax Bill

Itemizing is key.

Millennials, Don’t Forget Estate Planning

Putting it off could be a huge mistake.

7 Amazing Things to Be After You Die

A firework!

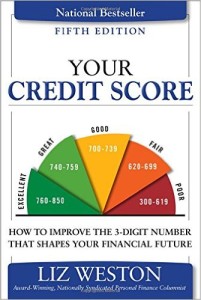

The U.S. cities with the best credit scores

Is yours on the list?

Today’s top story: Trump’s student loan repayment play vs. Obama’s REPAYE. Also in the news: What to do if you’re rejected for a checking account, how divorce can affect your credit score, and how easing your financial stress could help you live longer.

Today’s top story: Trump’s student loan repayment play vs. Obama’s REPAYE. Also in the news: What to do if you’re rejected for a checking account, how divorce can affect your credit score, and how easing your financial stress could help you live longer.  Today’s top story: Credit score companies ordered to pay millions in refunds. Also in the news: How the Trump presidency will impact housing, how to refresh your finances in the new year, and how to become an extreme saver in 2017.

Today’s top story: Credit score companies ordered to pay millions in refunds. Also in the news: How the Trump presidency will impact housing, how to refresh your finances in the new year, and how to become an extreme saver in 2017.  The Consumer Financial Protection Bureau today ordered Equifax and TransUnion to pay more than $23 million in restitution and fines for deceiving consumers about the usefulness and actual cost of credit scores they sold to consumers. Regulators said the bureaus also lured customers into expensive subscriptions when people thought they were getting free scores.

The Consumer Financial Protection Bureau today ordered Equifax and TransUnion to pay more than $23 million in restitution and fines for deceiving consumers about the usefulness and actual cost of credit scores they sold to consumers. Regulators said the bureaus also lured customers into expensive subscriptions when people thought they were getting free scores. Today’s top story: How to make the 10 years before retirement count. Also in the news: Tips on reining in holiday spending, which generation has the best credit score, and which insurance most car renters can say no to.

Today’s top story: How to make the 10 years before retirement count. Also in the news: Tips on reining in holiday spending, which generation has the best credit score, and which insurance most car renters can say no to.