Today’s top story: Don’t let your friends derail your finances. Also in the news: Protecting your EIF investments, how to fly with your baby, and why retailers are tracking your returns.

Today’s top story: Don’t let your friends derail your finances. Also in the news: Protecting your EIF investments, how to fly with your baby, and why retailers are tracking your returns.

Don’t Let Friends Derail Your Finances

How to stay on track and still have fun.

Are Your ETF Investments at Risk in a Market Sell-Off?

Potecting your investments.

How to Fly With Your Baby

Keeping your sanity in the skies.

Retailers Are Tracking Your Returns

Assigining a “risk score.”

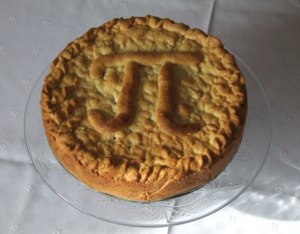

Today’s top story: 7 places to get a slice of savings on Pi Day. Also in the news: Choosing between a Roth 401(k) and a Roth IRA, guarding your cash from debit card fraud, and credit bureaus may get a boost from Congress.

Today’s top story: 7 places to get a slice of savings on Pi Day. Also in the news: Choosing between a Roth 401(k) and a Roth IRA, guarding your cash from debit card fraud, and credit bureaus may get a boost from Congress. Today’s top story: The most and least affordable places to buy a home. Also in the news: 3 investments that aren’t actually investments, why credit card rewards may lose their sparkle, and how to ask for a raise.

Today’s top story: The most and least affordable places to buy a home. Also in the news: 3 investments that aren’t actually investments, why credit card rewards may lose their sparkle, and how to ask for a raise.  Today’s top story: How to save green on St. Patrick’s Day. Also in the news: The bull market’s 9-year anniversary in 9 numbers, how to save on your destination wedding in Hawaii, and the financial and personal toll of family caregiving.

Today’s top story: How to save green on St. Patrick’s Day. Also in the news: The bull market’s 9-year anniversary in 9 numbers, how to save on your destination wedding in Hawaii, and the financial and personal toll of family caregiving.  Today’s top story: 5 reasons to lease – not buy – your electric car. Also in the news: CD early withdrawal penalties can cost you, how to read between the lines of Airbnb listings, and nearly 100,000 members of Generation Z already own a home.

Today’s top story: 5 reasons to lease – not buy – your electric car. Also in the news: CD early withdrawal penalties can cost you, how to read between the lines of Airbnb listings, and nearly 100,000 members of Generation Z already own a home. Today’s top story: Selling stocks in a panic could jack up your tax bill. Also in the news: This 5-minute task can protect your banking rep, how to get started with frequent flyer programs, and how your Amazon Echo could be making you spend more money.

Today’s top story: Selling stocks in a panic could jack up your tax bill. Also in the news: This 5-minute task can protect your banking rep, how to get started with frequent flyer programs, and how your Amazon Echo could be making you spend more money.