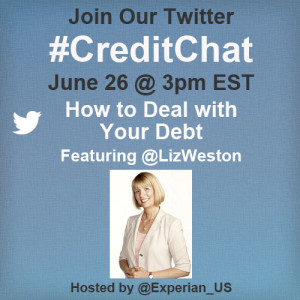

In a few minutes I’ll be answering your questions about how to deal with your debt on Experian’s #CreditChat, which starts at 3 p.m. Eastern/noon Pacific today. Topics include how to balance savings and paying off debt, which debts to tackle first, how to handle student loans and what to do if you’re drowning in debt. Easy ways to follow the conversation include Twubs or tchat.

In a few minutes I’ll be answering your questions about how to deal with your debt on Experian’s #CreditChat, which starts at 3 p.m. Eastern/noon Pacific today. Topics include how to balance savings and paying off debt, which debts to tackle first, how to handle student loans and what to do if you’re drowning in debt. Easy ways to follow the conversation include Twubs or tchat.

Please join us!