Today’s top story: What to do when your credit card issuer blindsides you. Also in the news: Watching for snags with free money offers, rock-solid tips for buying a diamond online, and how to make a grab for $150,000 in college scholarships.

What to Do When Your Credit Card Issuer Blindsides You

Expect the unexpected.

Free-Money Offers Can Be Alluring, but Watch for Snags

What to consider before signing up.

Rock-Solid Tips for Buying a Diamond Online

Getting the most for your money.

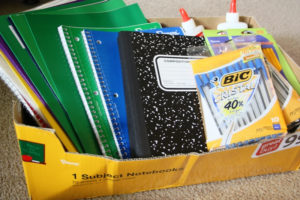

Need money for college? Here’s how to make a grab for $150,000 in scholarships.

Every bit helps.

Today’s top story: 5 things your credit reports won’t reveal. Also in the news: More credit card issuers are letting you pay off debt for free, everything you need to know about mortgage loan modifications, and how to stay debt-free during back-to-school shopping.

Today’s top story: 5 things your credit reports won’t reveal. Also in the news: More credit card issuers are letting you pay off debt for free, everything you need to know about mortgage loan modifications, and how to stay debt-free during back-to-school shopping. Today’s top story: The average American saves less than 5%. Also in the news: Strategies for lowering your closing costs, how to make money with YouTube, and should credit card perks coax you to go steady with a bank?

Today’s top story: The average American saves less than 5%. Also in the news: Strategies for lowering your closing costs, how to make money with YouTube, and should credit card perks coax you to go steady with a bank? Today’s top story: How to tackle credit card debt when you’re young and overspent. Also in the news: How to make it work when sharing expenses with roommates, how to honeymoon in style instead of debt, and how to pick a good kids’ savings account.

Today’s top story: How to tackle credit card debt when you’re young and overspent. Also in the news: How to make it work when sharing expenses with roommates, how to honeymoon in style instead of debt, and how to pick a good kids’ savings account.  Today’s top story: A car insurance quiz to see if you’re savvy or stumped. Also in the news: How to afford college as an older student, five ways car ads lie, and why habits that create good credit can still be a bad thing.

Today’s top story: A car insurance quiz to see if you’re savvy or stumped. Also in the news: How to afford college as an older student, five ways car ads lie, and why habits that create good credit can still be a bad thing.