Today’s top story: How the pandemic alters Americans’ financial habits. Also in the news: Navigating LGBTQ financial challenges, a July 15th tax extension reminder, and Americans are heading back to the stores.

Today’s top story: How the pandemic alters Americans’ financial habits. Also in the news: Navigating LGBTQ financial challenges, a July 15th tax extension reminder, and Americans are heading back to the stores.

Survey: How the Pandemic Alters Americans’ Financial Habits

Nearly 70% of Americans have been dealing with a negative impact to their finances.

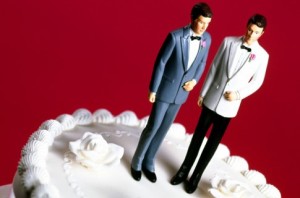

Q&A With Debt Free Guys: Navigating LGBTQ Financial Challenges

Happy Pride!

If You Request a Tax Extension, You Still Have to Pay by July 15

You must file AND pay.

Americans appear ready to shop again

Back to the stores.

Today’s top story: These are probably your best options for travel this summer. Also in the news: A new episode of the SmartMoney podcast on how the pandemic is changing our financial lives, how your state may let you deduct the costs of working from home during the pandemic, and 10 steps to avoiding tax-return identity theft.

Today’s top story: These are probably your best options for travel this summer. Also in the news: A new episode of the SmartMoney podcast on how the pandemic is changing our financial lives, how your state may let you deduct the costs of working from home during the pandemic, and 10 steps to avoiding tax-return identity theft.  Today’s top story: How to stand out in a tough job market. Also in the news: 3 ways to skip your bank’s long phone lines, how a temporary relocation during the pandemic may affect your taxes, and new HSA rules.

Today’s top story: How to stand out in a tough job market. Also in the news: 3 ways to skip your bank’s long phone lines, how a temporary relocation during the pandemic may affect your taxes, and new HSA rules. Today’s top story: 3 ways to skip your bank’s long phone lines. Also in the news: Keeping your credit in shape, even if you don’t have debt and don’t plan to borrow, 25 ways to save yourself from your debt disaster, and how to set up a 60/40 budget.

Today’s top story: 3 ways to skip your bank’s long phone lines. Also in the news: Keeping your credit in shape, even if you don’t have debt and don’t plan to borrow, 25 ways to save yourself from your debt disaster, and how to set up a 60/40 budget.  Today’s top story: 5 reasons it’s smart to lease a car right now. Also in the news: How to free up cash in your budget, how to decide what to leave your kids, and all the ways to get Amazon Prime for free.

Today’s top story: 5 reasons it’s smart to lease a car right now. Also in the news: How to free up cash in your budget, how to decide what to leave your kids, and all the ways to get Amazon Prime for free.