Today’s top story: How seniors can save money with discounts. Also in the news: Home equity borrowing and taxes, smart ways to save on car expenses, and the 3 times you shouldn’t ask for a raise.

Today’s top story: How seniors can save money with discounts. Also in the news: Home equity borrowing and taxes, smart ways to save on car expenses, and the 3 times you shouldn’t ask for a raise.

How Seniors Can Save Money With Discounts

Every penny counts.

Is Interest on Home Equity Borrowing Tax-Deductible

Understanding the rules.

Smart Ways to Save on Car Expenses

Tips to find savings.

3 times you shouldn’t ask for a raise

When the timing is right.

Today’s top story: 5 ways to invest in real estate. Also in the news: What makes small-cap stocks mighty (and risky), why auto insurance could be limited in self-driving cars, and how to negotiate a cheaper cellphone contract.

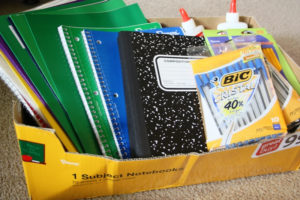

Today’s top story: 5 ways to invest in real estate. Also in the news: What makes small-cap stocks mighty (and risky), why auto insurance could be limited in self-driving cars, and how to negotiate a cheaper cellphone contract. Today’s top story: 5 things your credit reports won’t reveal. Also in the news: More credit card issuers are letting you pay off debt for free, everything you need to know about mortgage loan modifications, and how to stay debt-free during back-to-school shopping.

Today’s top story: 5 things your credit reports won’t reveal. Also in the news: More credit card issuers are letting you pay off debt for free, everything you need to know about mortgage loan modifications, and how to stay debt-free during back-to-school shopping. Today’s top story: The average American saves less than 5%. Also in the news: Strategies for lowering your closing costs, how to make money with YouTube, and should credit card perks coax you to go steady with a bank?

Today’s top story: The average American saves less than 5%. Also in the news: Strategies for lowering your closing costs, how to make money with YouTube, and should credit card perks coax you to go steady with a bank? Today’s top story: How to tackle credit card debt when you’re young and overspent. Also in the news: How to make it work when sharing expenses with roommates, how to honeymoon in style instead of debt, and how to pick a good kids’ savings account.

Today’s top story: How to tackle credit card debt when you’re young and overspent. Also in the news: How to make it work when sharing expenses with roommates, how to honeymoon in style instead of debt, and how to pick a good kids’ savings account.  Today’s top story: A car insurance quiz to see if you’re savvy or stumped. Also in the news: How to afford college as an older student, five ways car ads lie, and why habits that create good credit can still be a bad thing.

Today’s top story: A car insurance quiz to see if you’re savvy or stumped. Also in the news: How to afford college as an older student, five ways car ads lie, and why habits that create good credit can still be a bad thing.