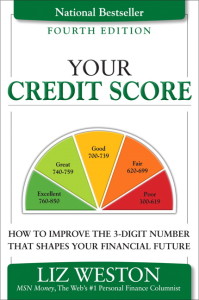

Too many people believe too many lies about credit scores, and it’s costing them money. Read the real scoop in my MSN Money column “Credit score myths that need to die.”

Too many people believe too many lies about credit scores, and it’s costing them money. Read the real scoop in my MSN Money column “Credit score myths that need to die.”

Our family may never achieve “zero waste,” but we’ve started some easy ways to reduce the amount of garbage we generate. More in “Are you ready for a zero-waste lifestyle?”

Kyle has a good job, and better health care coverage than her husband. He thinks those are reasons to keep working and create a more flexible schedule. But daycare is eating up most of her paycheck and she’s wondering if she should quit to stay home with their baby. Read my assessment, plus what you need to do if you’re considering becoming a stay-at-home parent, in Marketplace Money’s new feature “Financial Feud.”

Some financial missteps may not show up on your credit reports, but they’re big red flags that you’re headed for trouble. Read more in CardRatings.com’s “Danger ahead: 5 warning signs that won’t show up on your credit report.”