Today’s top story: Your guide to earning bonus miles with airline promotions. Also in the news: 4 important features to finding the perfect home, why some people don’t mind overpaying the IRS, and this cash-envelope budgeting system turns back-to-school shopping into a money lesson.

Today’s top story: Your guide to earning bonus miles with airline promotions. Also in the news: 4 important features to finding the perfect home, why some people don’t mind overpaying the IRS, and this cash-envelope budgeting system turns back-to-school shopping into a money lesson.

Your Guide to Earning Bonus Miles With Airline Promotions

Check out these limited-time offers.

Look for these 4 important features to find the perfect home

Sometimes good enough is perfect.

Here’s why these people don’t mind overpaying the IRS

They’d rather get a refund.

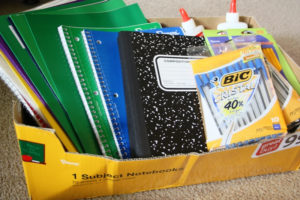

This cash-envelope budgeting system turns back-to-school shopping into a money lesson

Letting your kids make the decisions.

Today’s top story: How to outsmart smartphone scammers. Also in the news: 5 military budgeting tips, states that will pay you to work there, and just how worried you should be about a possible recession.

Today’s top story: How to outsmart smartphone scammers. Also in the news: 5 military budgeting tips, states that will pay you to work there, and just how worried you should be about a possible recession. Today’s top story: How to qualify for first-time home buyer benefits. Also in the news: The best investments you can make right now, how to bypass ATM fees while you’re on the road, and how financial therapy might help you get to the root of your money problems.

Today’s top story: How to qualify for first-time home buyer benefits. Also in the news: The best investments you can make right now, how to bypass ATM fees while you’re on the road, and how financial therapy might help you get to the root of your money problems.  Today’s top story: 5 cheaper alternatives to popular vacation spots. Also in the news: How credit unions fit in your financial life, how to prepare for an economic downturn, and the fee the IRS is waiving for more than 400,000 filers.

Today’s top story: 5 cheaper alternatives to popular vacation spots. Also in the news: How credit unions fit in your financial life, how to prepare for an economic downturn, and the fee the IRS is waiving for more than 400,000 filers.  Today’s top story: Apps that encourage you to spend. Also in the news: Advice for weaning your grown kids off your credit cards, why some people don’t mind overpaying the IRS, and how to protect yourself from falling interest rates.

Today’s top story: Apps that encourage you to spend. Also in the news: Advice for weaning your grown kids off your credit cards, why some people don’t mind overpaying the IRS, and how to protect yourself from falling interest rates. Today’s top story: How credit unions fit in your financial life. Also in the news: How to recover from being rejected for a personal loan, 5 simple ways to get out of credit card debt faster, and 9 ways to teach kids about money.

Today’s top story: How credit unions fit in your financial life. Also in the news: How to recover from being rejected for a personal loan, 5 simple ways to get out of credit card debt faster, and 9 ways to teach kids about money.