Today’s top story: What to buy for every month of the year. Also in the news: Why you should think twice before borrowing for your kid’s college, why you need to stop hoarding your credit card rewards, and why banks are starting to look more like cafes.

Today’s top story: What to buy for every month of the year. Also in the news: Why you should think twice before borrowing for your kid’s college, why you need to stop hoarding your credit card rewards, and why banks are starting to look more like cafes.

What to Buy Every Month of the Year in 2017

Shopping smart.

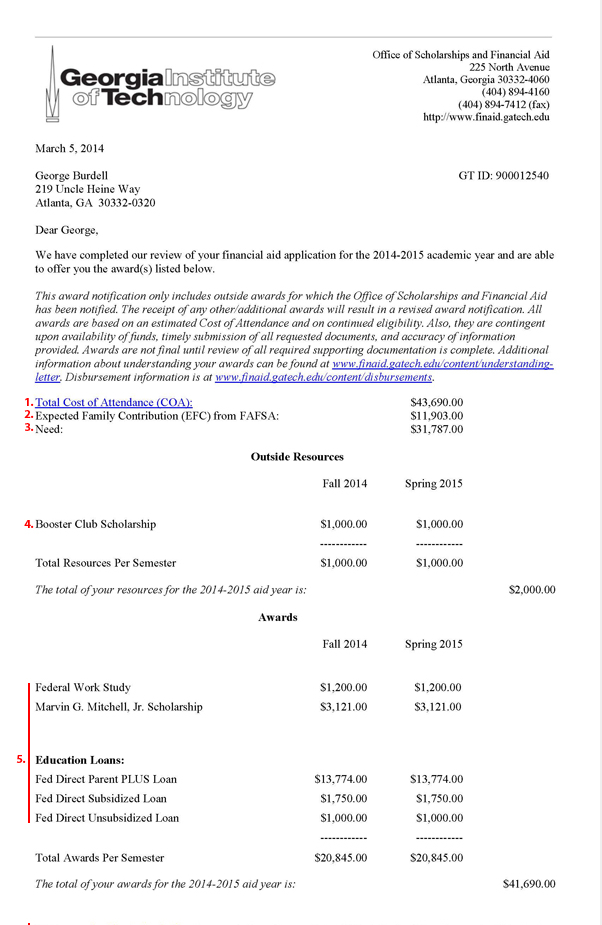

Think Twice Before Borrowing for Your Kid’s College

You could spend decades paying it back.

Credit Card Rewards Are for Spending, Not Hoarding

Use ’em before you lose ’em.

Decaf with your deposit, ma’am? Reinventing the bank branch

Get a latte with your loan.