How Boomers should prepare for Obamacare, the right time to purchase life insurance, and how to keep scammers away from your grandparents’ life savings.

Six Things Boomers Need to Know About Obamacare

Six Things Boomers Need to Know About Obamacare

Enrollment begins on October 1st.

Knowing When You Need Life Insurance

It’s likely sooner than you think.

Your Kids And Money: Teaching The Value Of A Dollar

Can giving your child an allowance teach them financial responsibility?

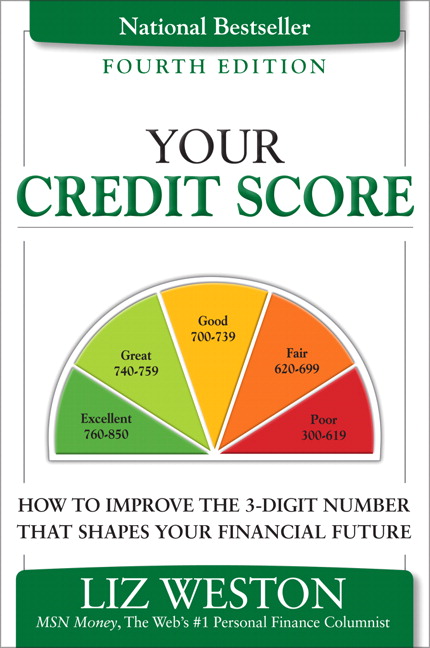

Will Making Minimum Payments Damage Your Credit Score?

Understanding the formulation of your credit score.

The Good News: Your Grandson Isn’t In Peruvian Prison. The Bad News: You Just Lost $250K

Protecting Grandma and Grandpa from scammers.