Today’s top story: What you need to save every day for a comfortable retirement. Also in the news: The three tax buckets, the 10 commandments of savings, and four boring but essential money conversations.

Today’s top story: What you need to save every day for a comfortable retirement. Also in the news: The three tax buckets, the 10 commandments of savings, and four boring but essential money conversations.

$82 a Day Is the Average Savings for a Comfortable Retirement

$82.28 to be exact.

What Pre-Retirees Should Be Asking About Taxes

Introducing the three buckets.

The 10 Commandments of Saving Money

Thou shall follow these rules.

4 Boring Money Talks You Need to Have

Boring but necessary.

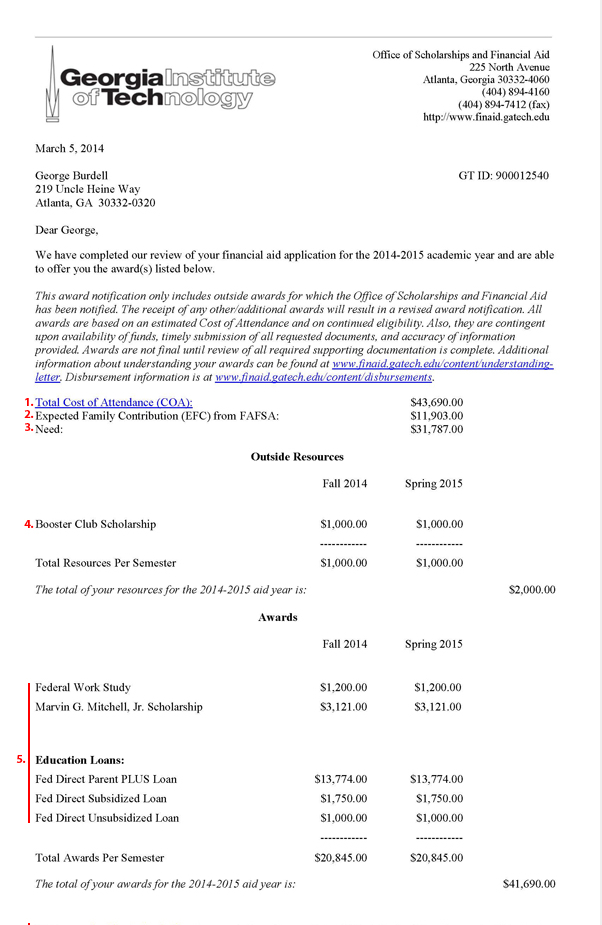

How to Find Financial Assistance for Your Down Payment

Don’t let your down payment hold you back.