Today’s top story: How to tackle your holiday debt. Also in the news: Saving time on your FAFSA, how to deal with debt before retirement, and the best financial tips that can fit on an index card.

Today’s top story: How to tackle your holiday debt. Also in the news: Saving time on your FAFSA, how to deal with debt before retirement, and the best financial tips that can fit on an index card.

Pay Off Your Holiday Bills in This Order

Tackling your holiday debt.

5 Hacks to Save Time on Your 2016 FAFSA

File as soon as possible.

5 Ways to Deal With Debt Before Retirement

Preparing for life on a fixed income.

Can The Best Financial Tips Fit On An Index Card?

4 x 6 inches of guidance.

12 Predictions For How Tech Will Change Your Financial Life In 2016

A glimpse into the future.

Today’s top story: The excuses that are keeping you from being debt-free. Also in the news: A major data breach at Time-Warner Cable, smart ways to spend your tax refund, and why most Americans couldn’t handle a surprise $500 bill.

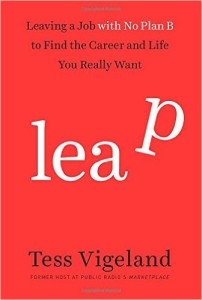

Today’s top story: The excuses that are keeping you from being debt-free. Also in the news: A major data breach at Time-Warner Cable, smart ways to spend your tax refund, and why most Americans couldn’t handle a surprise $500 bill.  I’m delighted to announce that I’ve accepted a job with Nerdwallet, the personal finance site, and to celebrate this leap I’m giving away a copy of Tess Vigeland’s wonderful memoir “Leap: Leaving a Job with No Plan B.”

I’m delighted to announce that I’ve accepted a job with Nerdwallet, the personal finance site, and to celebrate this leap I’m giving away a copy of Tess Vigeland’s wonderful memoir “Leap: Leaving a Job with No Plan B.” Today’s top story: What the recent Fed rate hike means for your adjustable-rate mortgage. Also in the news: One state moves to forgive student loans, how to write ironclad financial resolutions, and how to supercharge your retirement savings.

Today’s top story: What the recent Fed rate hike means for your adjustable-rate mortgage. Also in the news: One state moves to forgive student loans, how to write ironclad financial resolutions, and how to supercharge your retirement savings. Today’s top story: Scoring a lower credit card interest rate. Also in the news: the one resolution to improve your finances, creating your own financial plan, and why you need a budget, even if you’re broke.

Today’s top story: Scoring a lower credit card interest rate. Also in the news: the one resolution to improve your finances, creating your own financial plan, and why you need a budget, even if you’re broke.  Today’s top story: How to simplify your finances in 2016. Also in the news: The questions credit carholders should be asking, what homeowners can expect in 2016, and how long different items stay on your credit report.

Today’s top story: How to simplify your finances in 2016. Also in the news: The questions credit carholders should be asking, what homeowners can expect in 2016, and how long different items stay on your credit report.