Today’s top story: How seniors can save money with discounts. Also in the news: Home equity borrowing and taxes, smart ways to save on car expenses, and the 3 times you shouldn’t ask for a raise.

Today’s top story: How seniors can save money with discounts. Also in the news: Home equity borrowing and taxes, smart ways to save on car expenses, and the 3 times you shouldn’t ask for a raise.

How Seniors Can Save Money With Discounts

Every penny counts.

Is Interest on Home Equity Borrowing Tax-Deductible

Understanding the rules.

Smart Ways to Save on Car Expenses

Tips to find savings.

3 times you shouldn’t ask for a raise

When the timing is right.

Today’s top story: 5 ways to invest in real estate. Also in the news: What makes small-cap stocks mighty (and risky), why auto insurance could be limited in self-driving cars, and how to negotiate a cheaper cellphone contract.

Today’s top story: 5 ways to invest in real estate. Also in the news: What makes small-cap stocks mighty (and risky), why auto insurance could be limited in self-driving cars, and how to negotiate a cheaper cellphone contract. Today’s top story: 5 things your credit reports won’t reveal. Also in the news: More credit card issuers are letting you pay off debt for free, everything you need to know about mortgage loan modifications, and how to stay debt-free during back-to-school shopping.

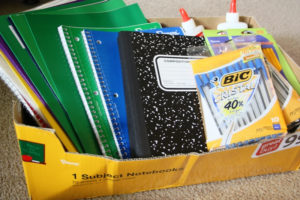

Today’s top story: 5 things your credit reports won’t reveal. Also in the news: More credit card issuers are letting you pay off debt for free, everything you need to know about mortgage loan modifications, and how to stay debt-free during back-to-school shopping.