Today’s top story: What would you give up to be debt free? Also in the news: What to know about alternative investments, what to buy (and skip) in August, and how money can actually buy happiness.

Today’s top story: What would you give up to be debt free? Also in the news: What to know about alternative investments, what to buy (and skip) in August, and how money can actually buy happiness.

What Would You Give Up to Be Debt-Free?

Making sacrifices.

Alternative Investments: What to Know Before You Buy

Investments beyond stocks.

What to Buy (and Skip) in August

Preparing for back-to-school.

Yes, you can buy happiness … if you spend it to save time

Spending it the right way.

Today’s top story: How to have healthy finances. Also in the news: Credit cards to pack for your road trip, learning about a Solo 401(k), and ten ridiculously easy ways to save $300 a month.

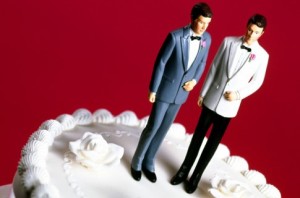

Today’s top story: How to have healthy finances. Also in the news: Credit cards to pack for your road trip, learning about a Solo 401(k), and ten ridiculously easy ways to save $300 a month.  Today’s top story: How much you should spend on a wedding gift. Also in the news: How health insurers are fighting opioid addiction, why new homeowners should plan for additional expenses, and how o turn your used electronics into cash.

Today’s top story: How much you should spend on a wedding gift. Also in the news: How health insurers are fighting opioid addiction, why new homeowners should plan for additional expenses, and how o turn your used electronics into cash. Today’s top story: How teachers can ace retirement without Social Security. Also in the news: Why credit cards are serving big restaurant rewards, making sure your spending personality matches your credit cards, and the one mistake that can cost millennials millions.

Today’s top story: How teachers can ace retirement without Social Security. Also in the news: Why credit cards are serving big restaurant rewards, making sure your spending personality matches your credit cards, and the one mistake that can cost millennials millions. Today’s top story: How financing a vacation with a credit card could ruin your fun. Also in the news: How immigrants can plan a comfortable retirement, how one immigrant started her financial journey in the U.S., and what to do if your defined benefit pension plan is frozen.

Today’s top story: How financing a vacation with a credit card could ruin your fun. Also in the news: How immigrants can plan a comfortable retirement, how one immigrant started her financial journey in the U.S., and what to do if your defined benefit pension plan is frozen. Today’s top story: How to keep an eye on your college kid’s spending. Also in the news: How to help your kid get a credit card in college, what you need to know about stock splits, and the 10 things every non-finance person needs to know about finance.

Today’s top story: How to keep an eye on your college kid’s spending. Also in the news: How to help your kid get a credit card in college, what you need to know about stock splits, and the 10 things every non-finance person needs to know about finance. Today’s top story: How to responsibly handle an inheritance. Also in the news: 7 questions to ask before selling a stock, how to create your own pension, and why 35% of college seniors don’t know what their student loan repayments will be.

Today’s top story: How to responsibly handle an inheritance. Also in the news: 7 questions to ask before selling a stock, how to create your own pension, and why 35% of college seniors don’t know what their student loan repayments will be.