Today’s top story: Deciphering the different types of credit scores. Also in the news: The mysteries of financial aid, authorized credit card users and bankruptcy, and how to plan your retirement regardless of employer contributions.

Today’s top story: Deciphering the different types of credit scores. Also in the news: The mysteries of financial aid, authorized credit card users and bankruptcy, and how to plan your retirement regardless of employer contributions.

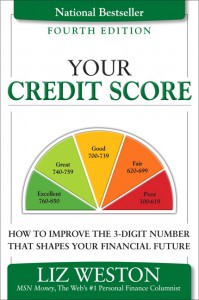

Which Credit Score Should I Check?

Understanding the different species of credit scores.

9 Things You Probably Didn’t Know About Financial Aid For College

Clearing up the collegiate confusion.

What Happens If Authorized User Goes Bankrupt

What impact will it have on your credit rating?

Don’t depend on your employer for retirement

Planning your retirement regardless of employee contribution is essential.

5 Money-Saving Tips for Small Business Owners

Save money and stress with these tips.