This week’s top story: Smart Money podcast on buy now, pay later loans and credit reports. In other news: What to do if your homebuying plan got scrapped this year, when the car market will return to normal, and 3 steps to lower the cost of your debt.

This week’s top story: Smart Money podcast on buy now, pay later loans and credit reports. In other news: What to do if your homebuying plan got scrapped this year, when the car market will return to normal, and 3 steps to lower the cost of your debt.

Smart Money Podcast: Money Hot Takes, and Too Many Credit Cards

This week’s episode starts with two hot takes from our hosts about buy now, pay later loans and credit reports.

What to Do If Your Homebuying Plan Got Scrapped This Year

Elevated prices, rising interest rates and steep competition are interrupting millennials’ plans to buy homes.

When Will the Car Market Return to Normal?

Car prices skyrocketed during the pandemic. It’s unlikely they’ll drop significantly anytime soon, experts say.

3 Steps to Lower the Cost of Your Debt

There are ways you can reduce the expense, but it helps to know each method’s details and trade-offs.

Today’s top story: What to know before accepting COVID-19 credit card relief. Also in the news: You can now get free weekly credit reports, how to get money to family and friends in a crisis, and what your small business should do with its Paycheck Protection Program loan.

Today’s top story: What to know before accepting COVID-19 credit card relief. Also in the news: You can now get free weekly credit reports, how to get money to family and friends in a crisis, and what your small business should do with its Paycheck Protection Program loan. Today’s top story: Small financial mistakes that could cost you big. Also in the news: Are certificates of deposit worth it right now, saving on vacations through Costco, and how changing your wireless plan could affect your credit report.

Today’s top story: Small financial mistakes that could cost you big. Also in the news: Are certificates of deposit worth it right now, saving on vacations through Costco, and how changing your wireless plan could affect your credit report. Today’s top story: The 3 reports you haven’t frozen yet. Also in the news: United halts the transport of pets in cargo holds, how to protect your 401(k) from rising interest rates, and how much your personal data is worth on the dark web.

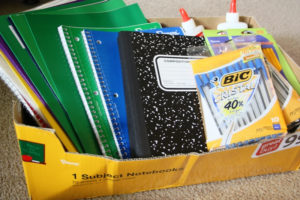

Today’s top story: The 3 reports you haven’t frozen yet. Also in the news: United halts the transport of pets in cargo holds, how to protect your 401(k) from rising interest rates, and how much your personal data is worth on the dark web.  Today’s top story: 5 things your credit reports won’t reveal. Also in the news: More credit card issuers are letting you pay off debt for free, everything you need to know about mortgage loan modifications, and how to stay debt-free during back-to-school shopping.

Today’s top story: 5 things your credit reports won’t reveal. Also in the news: More credit card issuers are letting you pay off debt for free, everything you need to know about mortgage loan modifications, and how to stay debt-free during back-to-school shopping.