No one cares as much about your money as you do, but never asking for help can be dangerous — and expensive.

In a previous column, I detailed the hazards of trying to do your own estate plan and how problems often aren’t apparent until it’s too late to fix them. The following financial tasks also are more complex than they may seem, and the consequences for ignorance can be severe. In my latest for the Associated Press, why hiring an expert help may ultimately save you a bundle.

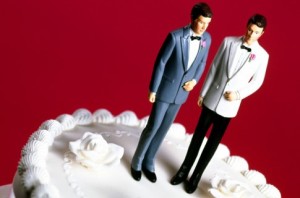

Today’s top story: 6 college money lessons you didn’t learn in high school. Also in the news: Affordable ways to refresh your home, 5 ways not to blow a financial windfall, and the high financial cost of being gay.

Today’s top story: 6 college money lessons you didn’t learn in high school. Also in the news: Affordable ways to refresh your home, 5 ways not to blow a financial windfall, and the high financial cost of being gay.  Today’s top story: How to make June’s Fed rate hike work for your savings. Also in the news: What the Fed rate hike means for your CDs, how to save money on wedding music, and making it easier for your loved ones to figure out your finances if you die.

Today’s top story: How to make June’s Fed rate hike work for your savings. Also in the news: What the Fed rate hike means for your CDs, how to save money on wedding music, and making it easier for your loved ones to figure out your finances if you die. Today’s top story: Why brand loyalty makes some blind to retail cards’ flaws. Also in the news: The good, the bad and the budget of destination weddings, how to save on central air, and what to know about your insurance when you’re on vacation.

Today’s top story: Why brand loyalty makes some blind to retail cards’ flaws. Also in the news: The good, the bad and the budget of destination weddings, how to save on central air, and what to know about your insurance when you’re on vacation.  Today’s top story: How 1% savings hikes can spice up retired life by $1 million. Also in the news: 7 ways to save at Disneyland, why you shouldn’t let a down payment scare you from buying a home, and how Millennial men and women invest differently.

Today’s top story: How 1% savings hikes can spice up retired life by $1 million. Also in the news: 7 ways to save at Disneyland, why you shouldn’t let a down payment scare you from buying a home, and how Millennial men and women invest differently. Today’s top story: Nondeductible IRA – for when you’re too rich for a regular one. Also in the news: How to get more bang for your beauty buck, how to know if your pet will dig a subscription box, and the 2018 FAFSA deadline is approaching.

Today’s top story: Nondeductible IRA – for when you’re too rich for a regular one. Also in the news: How to get more bang for your beauty buck, how to know if your pet will dig a subscription box, and the 2018 FAFSA deadline is approaching.