In case you missed them, here are some of the issues I’ve been writing about recently:

In case you missed them, here are some of the issues I’ve been writing about recently:

A much-heralded new version of the VantageScore could offer big benefits to consumers, but only if lenders actually start to use it. Read all about it in “New credit score could change lives.”

HSAs still aren’t a household acronym, but more companies are offering these health care accounts–and yours might be next. For the right people, HSAs can be a way to supercharge your retirement savings since they allow you to invest unused cash contributions in stocks. But you also run the risk of having the market wipe out your health care funds right when you need them. Read “Should you invest health care funds?” for more.

Divorce doesn’t necessarily separate your credit obligations, and a vengeful or oblivious ex can really mess up your credit. Learn what you should know before and after your split in “Don’t let your ex trash your credit.”

Are you giving identity thieves the clues they need to hack into your life? If you use social media, the answer may be yes. Read “Secrets you should yank off Facebook now.”

Dear Liz:

Do you know of good reputable credit repair companies in the New York City area. This is for getting advice on improving credit score.

Thanks, Puch

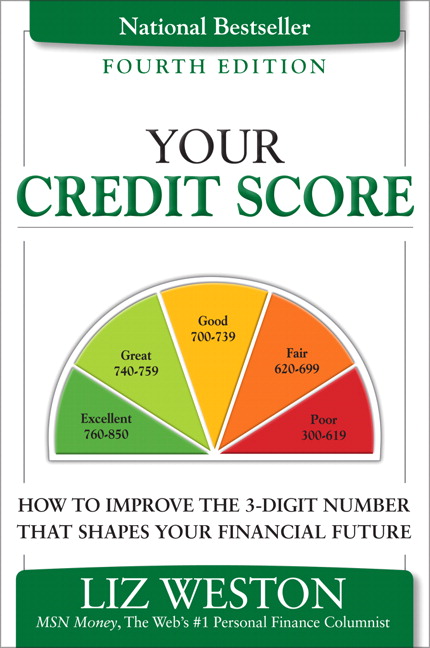

“Good reputable credit repair” is kind of an oxymoron. There’s so much fraud in this area that most people are better off just learning about how credit scores work and applying that information themselves. My book “Your Credit Score” is at most libraries; you might start there. If your credit scores are being affected by false information that the credit bureaus won’t delete, then you may want to hire an experienced attorney to help (you can get referrals at http://www.naca.net). But try the DIY approach first.