Today’s top story: Your guide to earning bonus miles with airline promotions. Also in the news: 4 important features to finding the perfect home, why some people don’t mind overpaying the IRS, and this cash-envelope budgeting system turns back-to-school shopping into a money lesson.

Today’s top story: Your guide to earning bonus miles with airline promotions. Also in the news: 4 important features to finding the perfect home, why some people don’t mind overpaying the IRS, and this cash-envelope budgeting system turns back-to-school shopping into a money lesson.

Your Guide to Earning Bonus Miles With Airline Promotions

Check out these limited-time offers.

Look for these 4 important features to find the perfect home

Sometimes good enough is perfect.

Here’s why these people don’t mind overpaying the IRS

They’d rather get a refund.

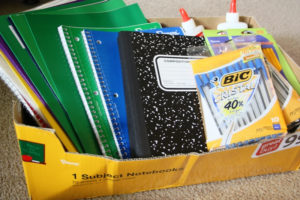

This cash-envelope budgeting system turns back-to-school shopping into a money lesson

Letting your kids make the decisions.

Today’s top story: How to qualify for first-time home buyer benefits. Also in the news: The best investments you can make right now, how to bypass ATM fees while you’re on the road, and how financial therapy might help you get to the root of your money problems.

Today’s top story: How to qualify for first-time home buyer benefits. Also in the news: The best investments you can make right now, how to bypass ATM fees while you’re on the road, and how financial therapy might help you get to the root of your money problems.  Today’s top story: 5 cheaper alternatives to popular vacation spots. Also in the news: How credit unions fit in your financial life, how to prepare for an economic downturn, and the fee the IRS is waiving for more than 400,000 filers.

Today’s top story: 5 cheaper alternatives to popular vacation spots. Also in the news: How credit unions fit in your financial life, how to prepare for an economic downturn, and the fee the IRS is waiving for more than 400,000 filers.  Today’s top story: How credit unions fit in your financial life. Also in the news: How to recover from being rejected for a personal loan, 5 simple ways to get out of credit card debt faster, and 9 ways to teach kids about money.

Today’s top story: How credit unions fit in your financial life. Also in the news: How to recover from being rejected for a personal loan, 5 simple ways to get out of credit card debt faster, and 9 ways to teach kids about money. Today’s top story: What to do when back-to-school bites you in the budget. Also in the news: Advice and warnings for starting your own cannabis business, why Millennials need to build credit smarts and find out of your state is having a back-to-school tax-free weekend.

Today’s top story: What to do when back-to-school bites you in the budget. Also in the news: Advice and warnings for starting your own cannabis business, why Millennials need to build credit smarts and find out of your state is having a back-to-school tax-free weekend.