Today’s top story: 5 things your credit reports won’t reveal. Also in the news: More credit card issuers are letting you pay off debt for free, everything you need to know about mortgage loan modifications, and how to stay debt-free during back-to-school shopping.

Today’s top story: 5 things your credit reports won’t reveal. Also in the news: More credit card issuers are letting you pay off debt for free, everything you need to know about mortgage loan modifications, and how to stay debt-free during back-to-school shopping.

5 Things Your Credit Reports Won’t Reveal

What’s missing from your credit report.

More Credit Card Issuers Let You Pay Off Debt for Free

It’s never been easier to transfer balances.

All You Need to Know About Mortgage Loan Modifications

Modifications could help prevent foreclosure.

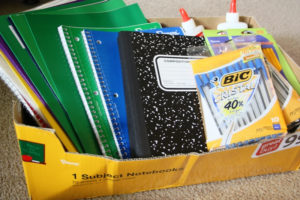

How to Stay Debt-Free During the Back-to-School Shopping Rush

Tips for getting it done.

Today’s top story: The average American saves less than 5%. Also in the news: Strategies for lowering your closing costs, how to make money with YouTube, and should credit card perks coax you to go steady with a bank?

Today’s top story: The average American saves less than 5%. Also in the news: Strategies for lowering your closing costs, how to make money with YouTube, and should credit card perks coax you to go steady with a bank? Today’s top story: Brace yourself for higher car insurance rates. Also in the news: 3 tax errors that could be hiding in your paycheck, how to make sense of your credit card number, and how other people’s weddings are preventing millennials from buying homes.

Today’s top story: Brace yourself for higher car insurance rates. Also in the news: 3 tax errors that could be hiding in your paycheck, how to make sense of your credit card number, and how other people’s weddings are preventing millennials from buying homes. Today’s top story: Don’t get taken by government grant scams. Also in the news: When you should and shouldn’t tap your Roth IRA, using your credit cards to pay for child care, and a report that finds many American teens lack basic financial skills.

Today’s top story: Don’t get taken by government grant scams. Also in the news: When you should and shouldn’t tap your Roth IRA, using your credit cards to pay for child care, and a report that finds many American teens lack basic financial skills. Today’s top story: How to have healthy finances. Also in the news: Credit cards to pack for your road trip, learning about a Solo 401(k), and ten ridiculously easy ways to save $300 a month.

Today’s top story: How to have healthy finances. Also in the news: Credit cards to pack for your road trip, learning about a Solo 401(k), and ten ridiculously easy ways to save $300 a month.  Today’s top story: How teachers can ace retirement without Social Security. Also in the news: Why credit cards are serving big restaurant rewards, making sure your spending personality matches your credit cards, and the one mistake that can cost millennials millions.

Today’s top story: How teachers can ace retirement without Social Security. Also in the news: Why credit cards are serving big restaurant rewards, making sure your spending personality matches your credit cards, and the one mistake that can cost millennials millions.