This week’s top story: Lousy customer service ‘designed for you to give up.’ In other news: What home shoppers need to know about the new buyer’s contracts, weekly mortgage rates tumble, and how to get your finances back on track for fall.

Biden Official: Lousy Customer Service ‘Designed For You to Give Up’

New government actions target “doom loop” customer service calls, fake reviews and subscription cancellations.

What Home Shoppers Need to Know About the New Buyer’s Contracts

Starting Aug. 17, home buyers will set their agents’ commissions and negotiate who will pay.

Weekly Mortgage Rates Tumble; Should You Refinance?

The rapid decrease is likely to set off a wave of refinancing.

How to Get Your Finances Back on Track for Fall

Reviewing spending and preparing for big expenses can help your budget recover from summertime.

This week’s top story: Avoiding 4 Prime Day pit falls. In other news: How to use buy now, pay later like a pro, 60/30/10 budget, and a court ruling that blocked lower student loan bills under the SAVE repayment plan has been overturned.

This week’s top story: Avoiding 4 Prime Day pit falls. In other news: How to use buy now, pay later like a pro, 60/30/10 budget, and a court ruling that blocked lower student loan bills under the SAVE repayment plan has been overturned. Today’s top story: 5 ways to prepare and pack for COVID-Era travel. Also in the news: 8 safety tips for solo female travel, how doing a subscription detox could plug monthly budget leaks, and how to take advantage of (and keep) a high credit score.

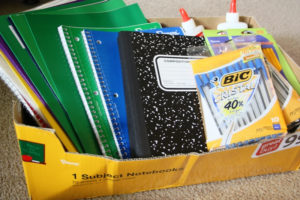

Today’s top story: 5 ways to prepare and pack for COVID-Era travel. Also in the news: 8 safety tips for solo female travel, how doing a subscription detox could plug monthly budget leaks, and how to take advantage of (and keep) a high credit score. Today’s top story: Your guide to earning bonus miles with airline promotions. Also in the news: 4 important features to finding the perfect home, why some people don’t mind overpaying the IRS, and this cash-envelope budgeting system turns back-to-school shopping into a money lesson.

Today’s top story: Your guide to earning bonus miles with airline promotions. Also in the news: 4 important features to finding the perfect home, why some people don’t mind overpaying the IRS, and this cash-envelope budgeting system turns back-to-school shopping into a money lesson. Today’s top story: Why you need a midyear budget check-in. Also in the news: Betterment hikes APY to 2.69% and adds checking and savings accounts, upgrading from your broker, and why you should always pay for a rental car with a credit card.

Today’s top story: Why you need a midyear budget check-in. Also in the news: Betterment hikes APY to 2.69% and adds checking and savings accounts, upgrading from your broker, and why you should always pay for a rental car with a credit card. Today’s top story: These 3 tricks can help you shop less. Also in the news: What you need to know about Slack’s IPO, a college survival guide for your money, and how to use travel rewards for a Memorial Day Weekend getaway.

Today’s top story: These 3 tricks can help you shop less. Also in the news: What you need to know about Slack’s IPO, a college survival guide for your money, and how to use travel rewards for a Memorial Day Weekend getaway.