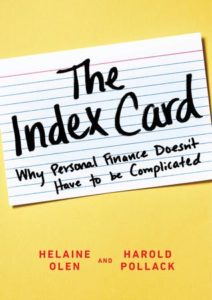

I’m giving away a copy of “The Index Card: Why Personal Finance Doesn’t Have to Be Complicated,” written by my friend Helaine Olen of Slate.com and Harold Pollack. These two cut through the hype and clutter to tell you what you really need to know about money.

I’m giving away a copy of “The Index Card: Why Personal Finance Doesn’t Have to Be Complicated,” written by my friend Helaine Olen of Slate.com and Harold Pollack. These two cut through the hype and clutter to tell you what you really need to know about money.

To enter to win, leave a comment here on my blog (not my Facebook page). Make sure to include your email address, which won’t show up with your comment, but I’ll be able to see it.

All comments are moderated, so it may take a little while for your comment to show up.

The winners will be chosen at random Friday night. Over the weekend, please check your email (including your spam filter). If I don’t hear from a winner by noon Pacific time on Monday, his or her prize will be forfeited and I’ll pick another winner.

Also, check back here often for other giveaways.

The deadline to enter is midnight Pacific time on Friday. So–comment away!

Today’s top story: Frightening types of 401(k) fees. Also in the news: It’s time for open enrollment, how to avoid bringing zombie debt back from the grave, and the staggering amount of money behind all things pumpkin.

Today’s top story: Frightening types of 401(k) fees. Also in the news: It’s time for open enrollment, how to avoid bringing zombie debt back from the grave, and the staggering amount of money behind all things pumpkin.