Today’s top story: 7 places to get a slice of savings on Pi Day. Also in the news: Choosing between a Roth 401(k) and a Roth IRA, guarding your cash from debit card fraud, and credit bureaus may get a boost from Congress.

Today’s top story: 7 places to get a slice of savings on Pi Day. Also in the news: Choosing between a Roth 401(k) and a Roth IRA, guarding your cash from debit card fraud, and credit bureaus may get a boost from Congress.

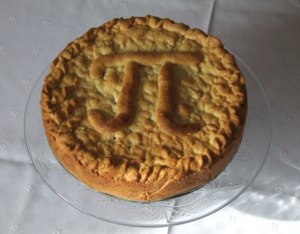

7 Places to Get a Slice of Savings on Pi Day

Happy 3.14!

Roth 401(k) vs. Roth IRA: Which Is Better for You?

Making the right choice.

Debit Card Fraud Still Rising; Here’s How to Guard Your Cash

Protecting your money.

Despite Equifax breach, Congress may boost credit bureaus

Rewarding bad behavior.

Today’s top story: The most and least affordable places to buy a home. Also in the news: 3 investments that aren’t actually investments, why credit card rewards may lose their sparkle, and how to ask for a raise.

Today’s top story: The most and least affordable places to buy a home. Also in the news: 3 investments that aren’t actually investments, why credit card rewards may lose their sparkle, and how to ask for a raise.  Today’s top story: How to save green on St. Patrick’s Day. Also in the news: The bull market’s 9-year anniversary in 9 numbers, how to save on your destination wedding in Hawaii, and the financial and personal toll of family caregiving.

Today’s top story: How to save green on St. Patrick’s Day. Also in the news: The bull market’s 9-year anniversary in 9 numbers, how to save on your destination wedding in Hawaii, and the financial and personal toll of family caregiving.