Few issues unite millennials like the future of Social Security. Overwhelmingly, they’re convinced it doesn’t have one.

A recent Transamerica survey found that 80% of millennials, defined in the survey as people born between 1979 and 2000, worry that Social Security won’t be around when they need it. That’s not surprising — for years, they’ve heard that Social Security is about to “run out of money.”

The language doesn’t match the reality. In my latest for the Associated Press, why the myths surrounding Social Security could cause problems for millennials and their retirement.

Today’s top story: Apple Card officially debuts, adding new rewards categories. Also in the news: 5 credit card perks you may not know you have, how to neutralize the digital threat you carry everywhere, and the best credit cards for grocery shopping.

Today’s top story: Apple Card officially debuts, adding new rewards categories. Also in the news: 5 credit card perks you may not know you have, how to neutralize the digital threat you carry everywhere, and the best credit cards for grocery shopping.  Today’s top story: Your guide to earning bonus miles with airline promotions. Also in the news: 4 important features to finding the perfect home, why some people don’t mind overpaying the IRS, and this cash-envelope budgeting system turns back-to-school shopping into a money lesson.

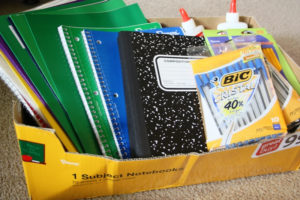

Today’s top story: Your guide to earning bonus miles with airline promotions. Also in the news: 4 important features to finding the perfect home, why some people don’t mind overpaying the IRS, and this cash-envelope budgeting system turns back-to-school shopping into a money lesson.