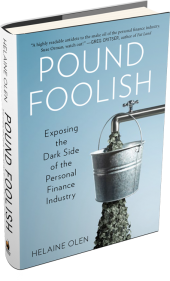

You may not agree with everything Helaine Olen writes in her new book, “Pound Foolish: Exposing the Dark Side of the Personal Finance Industry.” That’s particularly true if you’re an uncritical fan of one of the personal finance gurus she skewers so effectively.

You may not agree with everything Helaine Olen writes in her new book, “Pound Foolish: Exposing the Dark Side of the Personal Finance Industry.” That’s particularly true if you’re an uncritical fan of one of the personal finance gurus she skewers so effectively.

For the sake of your wallet, you should read the book anyway. She’s a friend of mine, so I’m biased, but the following sources are not:

- The New York Times, which called “Pound Foolish” one of the rare “realistic and readable” books about personal finance.

- The Washington Post’s Michelle Singletary, who says the book “provides a cautionary tale that you need to read.”

- The Economist says it’s an “excellent book, a contemptuous exposé of the American personal-finance industry.”

Helaine articulates what too many of us in the financial media took too long to figure out: that your money problems may not be entirely your own fault. Most Americans have been fighting economic headwinds for decades. Incomes have stagnated or even fallen while costs for education and health care spiral relentless upward. People can work for years to build up economic security only to have it wiped out when they lose their jobs, get divorced, suffer disability or illness or simply retire at the wrong time.

Here’s how the New York Times reviewer summarized it:

What most advice fails to factor in — and what we often choose to overlook ourselves — are the costly realities of things like job loss, protracted unemployment, medical bankruptcy and high-interest debt. Even when we do save, plummeting interest rates, falling home prices and other economic events imperil our best efforts.

Yet some of the best-known financial advice-givers make millions pretending that anyone can save his or her way to financial security. Meanwhile, legions of commissioned salespeople posing as advisors fleece people out of billions more, selling overpriced insurance and investment products to people desperate for financial guarantees.

I’m not saying, as some commentators have, that saving is pointless or impossible on modest incomes. That just plays into the hands of those who contend that financial issues are entirely a matter of personal responsibility, since they (and I) can provide plenty of examples of people who have saved prodigious amounts on small incomes, even in high-cost areas.

What the “personal responsibility” folks are missing is how easy it is to lose those savings in the 21st century, especially if you weren’t born to the right parents or are otherwise are on the wrong side of the growing wealth and income disparities.

Simply put, there are limits to how much personal finance advice or “financial literacy” efforts can help people who don’t make much money, don’t have a lot of education or aren’t just plain lucky in the lottery of life.

Personal responsibility alone isn’t enough; we need some corporate responsibility and a government capable of enforcing regulations that ensure fair play. We need affordable, available health insurance to protect people from catastrophic medical bills; we need a strong Social Security system to prevent us from ending our days in poverty. Our kids need affordable educations so more of them have a shot at staying in the middle class without drowning themselves in student loan debt.

In short, we need to stop acting like we’re in this alone. We should continue contributing to our 401(k)s, but we—and those who advise us—shouldn’t pretend that’s all we need to do to ensure our financial futures.

It sounds very interesting. I will have to add it to my to read list.

Thanks, Liz – the book looks fascinating, and I just ordered a copy.

I’m privileged to have been born to parents who got me a good start in life (got me a good education, taught me all the right habits, etc.), and to be really good at math. So for right now, my finances are in good shape. I could use a reminder not to get too smug.

I just finished reading the book. It was interesting, but also somewhat disappointing.

I really appreciated the overarching theme that too many people in personal finance have too many close ties to the financial industry to give advice that’s really in the best interest of the people they’re claiming to help. And I understand the notion that a personal solution to a societal problem can never be entirely successful.

But I think the book goes too far in the opposite direction – arguing that because people often face financial problems that are beyond their control, there’s no point in advising them on how best to manage the parts of their finances that are within their control.

I guess the point is that Suze Orman, Dave Ramsey, and the like COULD be using their clout to take on the big banks, if they weren’t too busy taking the banks’ money to push their products?