Today’s top story: Are you behind the financial times? Also in the news: How to better organize your bills, talking with your family about inheritance, and learning the five parts of your credit score.

Today’s top story: Are you behind the financial times? Also in the news: How to better organize your bills, talking with your family about inheritance, and learning the five parts of your credit score.

6 Signs You’re Behind the Financial Times

Still writing checks?

4 Ways to Better Organize Your Bills

And kiss late fees goodbye in the process.

On Inheritance, UBS Urges Families to Break the Silence

The importance of difficult conversations.

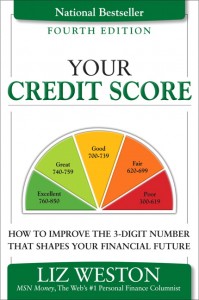

Everyone Should Know the 5 Parts of a Credit Score; Do You?

Let’s find out.

5 Ways to Make Peace With Money

What to do when money is your nemesis.