Today’s top story: Why rising car prices make gap insurance worth a look. Also in the news: The fed interest rate hike, and what a credit card authorized user is, how to apply for a credit card, and how to handle a windfall.

Today’s top story: Why rising car prices make gap insurance worth a look. Also in the news: The fed interest rate hike, and what a credit card authorized user is, how to apply for a credit card, and how to handle a windfall.

Why Rising Car Prices Make Gap Insurance Worth a Look

If your car is totaled or stolen and you owe more than it’s worth, gap insurance can help pay the difference.

Smart Money Podcast: The Fed Interest Rate Hike, and What’s a Credit Card Authorized User?

Higher interest rates may affect your mortgage and credit card payments, as well as everyday finances.

How to Apply for a Credit Card: Questions You’ll Be Asked

Applying for a credit card isn’t hard, but it helps to know in advance what information you’ll need.

‘Where’d the Money Go?’ How to Handle a Windfall

A windfall can either be a lifeline to short-term financial relief or a stepping stone to long-term financial stability.

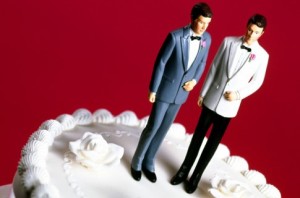

Today’s top story: 6 college money lessons you didn’t learn in high school. Also in the news: Affordable ways to refresh your home, 5 ways not to blow a financial windfall, and the high financial cost of being gay.

Today’s top story: 6 college money lessons you didn’t learn in high school. Also in the news: Affordable ways to refresh your home, 5 ways not to blow a financial windfall, and the high financial cost of being gay.