I’m hosting NerdWallet’s first Facebook Live video, “Using Debt Strategically,” on Thursday starting at 7 p.m. Eastern/4 p.m. Pacific. I’ll be discussing ways to prioritize your debt and pay it off faster while building your overall wealth. Whether you’re struggling with debt or just trying to be smarter with it, I can help answer your questions. Like NerdWallet on Facebook for updates and alerts on this event: nerd.me/facebook.

My new job–and a book giveaway!

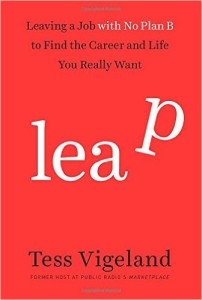

I’m delighted to announce that I’ve accepted a job with Nerdwallet, the personal finance site, and to celebrate this leap I’m giving away a copy of Tess Vigeland’s wonderful memoir “Leap: Leaving a Job with No Plan B.”

I’m delighted to announce that I’ve accepted a job with Nerdwallet, the personal finance site, and to celebrate this leap I’m giving away a copy of Tess Vigeland’s wonderful memoir “Leap: Leaving a Job with No Plan B.”

To enter to win, please leave a comment here on my blog (not my Facebook page).

You can add a comment below. Make sure to include your email address, which won’t show up with your comment, but I’ll be able to see it.

All comments are moderated. So it may take a little while for your comment to show up. But rest assured, it will.

The winners will be chosen at random Friday night. Over the weekend, please check your email (including your spam filter). If I don’t hear from a winner by noon Pacific time on Monday, his or her prize will be forfeited and I’ll pick another winner.

Also, check back here often for other giveaways.

The deadline to enter is midnight Pacific time on Friday. So–comment away!

Find cheaper checking and ditch your bank

If you’re sick of rising bank fees, check out a new feature at NerdWallet that allows you to compare the costs of more than 120 different checking accounts across a spectrum of banks and credit unions.

If you’re sick of rising bank fees, check out a new feature at NerdWallet that allows you to compare the costs of more than 120 different checking accounts across a spectrum of banks and credit unions.

You’ll answer a few questions about how you use your account, including the minimum balance you can maintain and how much you’ll deposit each month. The feature serves up the best matches based on your answers. If you have enough cash on hand to qualify for an interest-bearing checking account, the feature can help you find some good options.

You also might want to read a couple of my previous posts on this topic: “How to shop for a new bank” and “7 steps to say ‘buh-bye’ to your bank.”

Changing banks isn’t hassle-free, but you can save some decent money switching to an institution that actually wants your business, rather than punishing you for it.